The Myth of “Big Organic”

Right now, the organic industry is growing at what seems like breakneck speed. Consumers can’t seem to get enough of it. The U.S. organic food market is expected to grow 14% from 2013-2018.

Investors are betting on it, and big food companies are, too. General Mills dropped $820 million to acquire Annie’s, Hormel paid $775 million to purchase Applegate. Wall Street is betting on it.

When Annie’s went public back in March of 2012, the company saw the biggest opening day gain of any company in any industry in almost a year under the ticker symbol BNNY. What does that mean? It means that Wall Street got more excited about a bowl of mac and cheese that didn’t have a bunch of junk in it than any other technology in any industry.

The numbers don’t lie. Big food sees big opportunity in the organic industry and is buying it up. Coca Cola and Goldman Sachs recently acquired an almost 50% stake in Suja, an organic juice company that is a millennial favorite. Why? Because they see the growth.

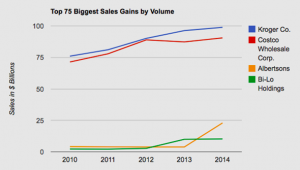

Kroger is expanding its organic product offering, Wal-Mart is launching a private label line, and Safeway is committing to further growth in the space. Demand is growing in zip codes around the country, not just in those for Whole Foods shoppers.

Kroger, back in 2012, launched its “Simple Truth” line, a private label free from a lot of artificial ingredients, additives and “Simple Truth Organic” which is free from high fructose corn syrup, GMOs, artificial colors, artificial growth hormones and more. What happened? The Simple Truth division went from $0 to almost $1 billion in revenue in a two year period.

So what’s going on? And is it sustainable?

Right now, its’ not sustainable at all. The organic industry is growing at an incredible clip, one that is attractive to any investor, but the underlying fundamentals need to be restructured.

Why? Of the 915 million acres that we have under farm management in the United States, only 5.5 million are organic farmland. Less than 1%.

So we have an industry that is growing at 14% a year, that represents only 5% of the total U.S. food market, but is less than 1% of U.S. farmland.

Big Organic? More like big supply problem. For the industry to grow, farmland has to be converted. Perhaps that is why General Mills just committed to doubling the amount of organic acreage under management by 2020.

It can’t happen soon enough for shareholders and for spoon holders. The demand is obvious.

But “Big Organic”? At less than 1% of U.S. farmland with organic acreage, that is a big myth.

If we want to scale the organic industry, not only for our families, but also for the food companies that are buying into it, we have to address this bottleneck. If the Grocery Manufacturers Association is truly acting in the interests of its member companies, it should be leading the charge. It isn’t.

Which begs the question? Who will.

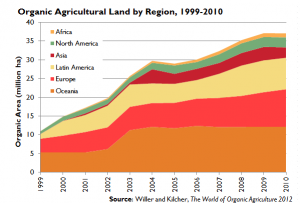

There is large regional variation in the area of land farmed organically. Oceania, which includes Australia, New Zealand, and Pacific Island nations, leads the world in certified organic land. Europe is close behind. The U.S. is lagging. Organic isn’t a silver bullet, but it also isn’t a fad.

There is large regional variation in the area of land farmed organically. Oceania, which includes Australia, New Zealand, and Pacific Island nations, leads the world in certified organic land. Europe is close behind. The U.S. is lagging. Organic isn’t a silver bullet, but it also isn’t a fad.

Right now, in the United States, the Organic Trade Association is trying to expand organic acreage under management. But before roll your eyes and say, “Well, obviously.” Interestingly, it’s an association whose members also include companies like General Mills.

Over 3,000 farms are transitioning to organic across the country. 51% of families are buying more organic products than a year ago. In other words, this isn’t a niche anymore. So how do we address this growing demand as a country with such a limited supply?

Sales of organic food and non-food products in the United States totaled $39.1 billion in 2014. Total sales of Coca Cola alone was greater than the entire organic industry at $45.9 billion. The combined market caps of Coca Cola and Pepsi are ten times the size of the entire organic industry. Organic sales now near a milestone of 5% share of the total food market. Big Organic? Hardly.

Room for growth? Definitely. And that can look like either a threat or an opportunity.

So why the pushback? Why the defamation and slander? Doesn’t it seem to be in the best interests of both shareholders of the companies investing in the industry as well as the growing number of consumers who want it? Supply and demand would indicate that an increase in supply would help to bring pricing down. Doesn’t it seem to be in the interest of the 51% of families purchasing organic to make it more available and more affordable?

The industry is growing at 14% but still only represents 5% of the total food market. To hear the opposition talk, you’d think it was big, really BIG. At less than 1% of U.S. farmland as organic acreage, it’s anything but.

Whole Foods can’t solve that for us. They are 3% of grocery. Kroger, Costco, Wal-Mart and Safeway can. A change in thinking can. Big Food can. And the biggest ask that we could be making of these companies is for them to commit to expanding organic acreage and to address this bottleneck.

Right now, conventional food has 95% of the playing field. Organic, while growing, has only 5%. To hear the opposition, you’d think it was a tied ballgame. It’s anything but. If we leveled the playing field, can you imagine what might happen? For farmers, food companies and the 51% of families who are now buying organic?

The landscape in front of us is wide open.

Sources:

Food Navigator: http://www.foodnavigator-usa.com/Markets/US-organic-food-market-to-grow-14-from-2013-18

World Watch: http://www.worldwatch.org/certified-organic-farmland-still-lagging-worldwide

Organic Trade Association: https://www.ota.com/resources/market-analysis#sthash.dZleoIF0.dpuf