5 Megatrends Shaping Every Industry + the Future Leadership Required to Succeed

If nature taught us anything, it’s that homogenous systems fail.

That homogeneity is pervasive in corporations, where diversity is lacking in the C-Suite and on boards, and it’s also deeply lacking in funding opportunities. Women do not have access to funding opportunities, which means innovation and emerging leadership is coming from a homogenous demographic, not a diverse base, and it shows. A global survey of CEOs, released this week, reveals that a special kind of leadership will be required because deep change is possible only when individuals at all levels adapt and grow.

TechCrunch reported that in 2012, women raised 1.8%, then 1.7% in 2016. And in 2021, there was an anomaly, which saw 2.3% of venture dollars allocated to all-female U.S. teams. For 2022, that number was tracking back down at 1.9%.

In Europe, the story is quite similar, although 2020 was the standout year that saw women raise 2.4% of all venture capital on the continent. Last year paints a more realistic picture: All-women teams raised only 1.1% of all venture funds in Europe. Only 1.1%.

That’s abysmal. It’s tough to lead when you don’t have access to capital.

So when PwC released its 26th Annual Global CEO Survey this week, it wasn’t surprising. And you get a sense that a lot of these leaders don’t know what to do. They’ve been operating with a system that worked in the 20th century, but a system that is now failing them in the 21st century.

The data suggests that a special kind of leadership will be required because deep change is possible only when individuals at all levels adapt and grow.

So let’s dig into it:

Roughly 40% of CEOs from 105 countries and territories predict their organizations won’t be economically viable in a decade if they continue on their current trajectories.

The pattern is consistent across a range of economic sectors, including technology (41%), telecommunications (46%), healthcare (42%) and manufacturing (43%).

52% of CEOs think that labor/skills shortages will impact their profitability to a large or very large extent over the next 10 years – a top 3 issue for them. (As our friends at Danone candidly told us, COVID took the lives of 1.1 million to date, many who worked in their supply chains, as truck drivers, field workers and more)

When asked about the forces most likely to impact their industry’s profitability over the next ten years, about half or more of surveyed CEOs cited changing customer preferences, regulatory change, skills shortages and technology disruption.

Roughly 40% flagged the transition to new energy sources and supply chain disruption. And nearly one-third pointed to the potential for new entrants from adjacent industries.

Five broad mega-trends emerged—climate change, technological disruption, demographic shifts, a fracturing world and social instability.

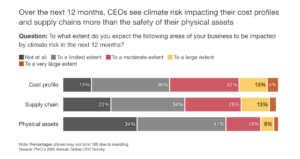

A majority of global CEOs expect some degree of impact from climate change in the next 12 months—primarily in their cost profiles (where approximately 50% expect a moderate, large or very large impact) and their supply chains (42%). Fewer (24%) are worried about climate-related damage to their physical assets.

Combating climate change requires a coordinated, long-term plan. It won’t be solved if the only companies working on it are those that face immediate financial impact.

Perhaps that’s the frustration we are feeling in the food industry right now. It’s impacting us. Corporates are telling us that climate change is costing them anywhere between $30-50 million a year. In others words, the food industry is on its knees.

Many companies are trying to decarbonize, innovate and craft climate strategy in parallel

According to the PwC report, many companies appear to be strategizing today without the information provided by an internal pricing mechanism for carbon. More than half of all CEOs in the survey (including 38% of those at the biggest companies and 70% of those at US companies) say that their company has no plans to apply an internal carbon price to decision-making, even though doing so could help them account for considerations like taxes and incentives, and clarify strategic trade-offs.

To make matters worse, 87% of global investors said they think corporate reporting contains unsubstantiated sustainability claims, often referred to as “greenwashing.”

The disconnect across time horizons begs the question of whether CEOs run the risk of being blindsided in the near term as they focus on here-and-now threats. Inflation and macroeconomic volatility stand our more prominently than other key threats.

Nearly three-quarters of CEOs responding to this year’s survey project that global economic growth will decline over the next 12 months.

CEOs who say they are exposed to geopolitical risk are taking action, with nearly half increasing their investments in cybersecurity or data privacy, adapting supply chains or adjusting their geographic footprint.

Boosting supply chain resilience has been a growing priority for many organizations since at least 2020.

Technology investments are a top priority: around three-quarters of companies are focused on automation, up-skilling, and deploying advanced technologies such as AI. Drilling down into the underlying rationale for those investments, roughly 60% in each category is focused on reinventing the business for the future, and 40% is concentrating on preserving the current business. That 60/40 ratio was remarkably consistent across the full spectrum of investments—another reflection of the balancing act CEOs are striving to strike.

Business reinvention will be a full-contact sport for CEOs and their top teams during the years ahead, and the data suggests that a special kind of leadership will be required because deep change is possible only when individuals at all levels adapt and grow.

What this report failed to capture (or maybe it did and it wasn’t shared) is the demographic makeup of these CEOs. How many are women? How many are people of color? How many LGBTQ+?

If the past and current venture capital funding are any indication, not nearly enough.

And you know who has the skill set to adapt and grow? The skills needed during these turbulent times? The very cohort not getting funded.

Resiliency, creativity, collaboration and courage are abundant in those who have had to figure out how to make it happen without access to capital. And the faster you can get us onto your boards and leadership teams, the better you will be for it.

The food industry is the canary in the coal mine. And it’s on its knees. Everyone from CEOs to private equity teams are talking about how their COGS are getting hammered. How their work force has been impacted, and where there are labor shortages, in factories, on farms. We are all experiencing that hammering impact first hand, with the sticker shock we are seeing at grocery stores and things like egg-less shelves. Eggs alone have seen a 49% price increase over last year. It’s a sensitive industry, sensitive to all of these trends: climate change, technological disruption, demographic shifts, a fracturing world and social instability.

So the question is: Are we paying attention? Because the food industry is already telling us what this report just revealed.

A special kind of leadership is required as we move forward, leaders with courage, creativity, empathy, emotional intelligence, collaborative skills and the ability to build strong coalitions, and the faster you embrace that, adapt and grow, the more resilient you and your organization will be.

Source: PwC released its 26th Annual Global CEO Survey