Is Monsanto Planning to Sell its Roundup Division?

Lower commodity prices and slower growth are forcing the agrochemical industry into M&A talks, according to Bloomberg.

Monsanto has approached Syngenta about a takeover that would create a giant in the market for seeds and crop chemicals with more than $30 billion in revenue. Getting a deal approved by regulators won’t be easy — and may not happen at all…

To address antitrust issues and help its case, Monsanto has planned for a deal to include a sale of parts of the combined business, a person familiar with the matter has said.

Roundup’s Headwinds

The seed company’s CEO Hugh Grant calls Roundup cancer concerns a ‘distraction rather than a reality.’

The reality is that countries like the Netherlands have banned the product.

When asked directly about the issue, Grant said he didn’t see the issue impacting the business, and that the company will continue to support the product. He called it “unfortunate noise” and a “distraction.”

A look inside Monsanto’s business model reveals some interesting trends and what could be driving a merger and a possible spinoff.

Where it gets interesting is that Monsanto isn’t the only one looking at Syngenta. Private equity groups, Dow and DuPont are also likely suitors.

So why the financial engineering of its business model?

Sales of what Monsanto labels its “agriculture productivity products,” which includes Roundup and similar items, account for about a third of the company’s annual revenue.

Considering industry headwinds such as lower corn production in U.S. and appreciation of U.S. currency, Monsanto has lowered its earnings per share (EPS) guidance for fiscal 2015.

The World Health Organization just declared the ingredient in their signature product, Roundup, a possible carcinogen.

Declining commodity prices aren’t helping.

Corn seed sales are slowing and consolidation would allow for cost cutting measures.

Private equity firms, Dow, Dupont could all line up as potential acquirers of the Roundup line, enabling Monsanto to get the liability off of its balance sheet.

Licensing agreements could enable the company to continue to see a revenue stream from their product given how that it is required for use with their genetically engineered, Roundup Ready crops, while distancing itself from some of the health concerns.

Tax issues and currency risks could also be helped by an offshore merger.

As commodity prices slump, the company is also facing declining borrowing capacity that is based in part on the value of inventory, which has seen a decrease in the midst of corn prices falling.

Amidst all of these challenges and increased scrutiny of its signature product, Roundup, Monsanto could use a merger to divest of its Roundup division.

Glyphosate has been around since 1970 and has been reviewed by multiple regulatory bodies since, including the Environmental Protection Agency. The EPA originally determined that it might cause cancer, but reversed its decision six years later after re-evaluating the study. At the beginning of April, headlines around the world shared that the World Health Organization had declared it a possible carcinogen.

There are a lot of ways to look at the story right now, but it’s especially important to look at how it is impacting farmers.

If you go back to August 2014, forecasters predicted that Argentina was going to plant less corn due to increasing interest rates making loans to farmers more difficult. Other countries are also planting fewer acres of genetically modified crops or rejecting them altogether. In other words, the growth trajectory began to slow.

In October 2014, Monsanto issued cautionary guidance, suggesting that their earnings could be off by as much as 50%. It was a strategic move and is often used on Wall Street, guide numbers down so that you are certain to be able to beat the estimates and provide an upside surprise. It rallies the stock for shareholders.

And that is exactly what Monsanto did.

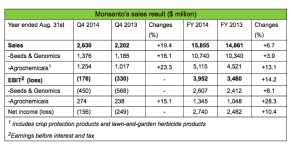

Monsanto’s earnings were mixed.

But how is this impacting farmers?

At a recent meeting in Missouri that I attended, farmers quietly shared how Monsanto is laying off employees. Earnings weren’t down by the forecasted 50%, but they were down by 34%. Revenue was off, too, and farmers were reporting on the impact.

It’s no secret that government subsidies support this industry. The biotech industry and the chemical companies selling genetically engineered seeds and the portfolio of products needed to grow them enjoy a government sponsored, financial advantage in the form of subsidies.

So how did Monsanto miss?

Currency is playing a role, oil prices, safety concerns, geopolitical maneuvering, as countries like China and Russia, reject Monsanto’s products. Food is a political football.

Corn prices are down.

On top of that, advance contract buys of the agrochemical products used on these crops are also down as farmers are putting off input decisions due to low crop prices. The same thing is happening in fuel and fertilizer. Experts are advising that farm income will be down and for farmers to reconsider cash outlays, capital purchases, etc., based on an expected large dip in net proceeds from the 2015 crop. Farmers are hunkering down. On top of that, the volatility in fertilizer pricing can be one of the more uncertain inputs for farmers, so a hesitation in purchasing is not a surprise.

According to Schnitkey, G. “IFES 2014: 2015 Crop and Income Outlook: Conserve Cash Income.” farmdoc daily, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 30, 2014, “Gross revenues in 2014 are projected to be below total costs. Similarly, 2015 gross revenue is projected to be below 2015 costs.”

That’s not only hammering top line growth but also the value of Monsanto’s inventory.

More Headwinds

And it’s not just U.S. farmers that are hesitating on these purchases. China was once a large importer of these chemicals, and that has stopped. China’s eleven month agchem export is up by 11%, with 17 newly approved pesticides in China.

And all of this happened prior to the recent World Health Organization announcement that the ingredient in Monsanto’s signature product, glyphosate, is a “probable carcinogen.”

In October 2014, Monsanto (NYSE:MON) missed expectations as sales fell 36% in. Revenues of $1.7Bn missed analyst expectations of $1.98Bn by a pretty wide margin (more than 10%).

In October 2014, Monsanto (NYSE:MON) missed expectations as sales fell 36% in. Revenues of $1.7Bn missed analyst expectations of $1.98Bn by a pretty wide margin (more than 10%).

On top of concerns over the price of corn, extended lower fuel prices could also eat away at the margin between gasoline and ethanol, making ethanol less cost-competitive and ultimately holding the potential to cut demand, thereby further lowering corn prices. There are already calls on capping ethanol, so the world’s largest seed company by sales has been increasing investments intended to bolster growth. An acquisition of Syngenta would further bolster that growth.

In the meantime, Monsanto has been running a share buyback program that is larger than any in the company’s history, and it’s been financed by debt.

Financial Engineering

Debt financings may not be in the best interest of shareholders over the long term. Share buybacks prop up the share price in the short term, but when they are financed with debt, the process also levers up the company.

So what could Monsanto do? Where could they find the cash to financially reengineer some of these issues?

Under a merger, Monsanto could restructure its balance sheet and portfolio, addressing the increased concerns around Roundup by selling off the division and using the proceeds for an acquisition.

The seed company’s CEO Hugh Grant calls Roundup cancer concerns a ‘distraction rather than a reality.’ Is it a big enough distraction to divest?

When asked directly about the issue, Grant said he didn’t see the issue impacting the business, and that the company will continue to support the product. He called it “unfortunate noise.”

But a Monsanto-Syngenta merger would allow a graceful exit strategy for the Roundup division.

It’s not an unprecedented move. Monsanto has a similar experience with another of its products, Posilac, recombinant bovine growth hormone, when it came under increased scrutiny and public concern. When the science got controversial and consumers caught wind of it, the market responded with manufacturers labeling their products as “rbGH-free” and Monsanto sold the dvision to Eli Lilly. Consumers, once educated, wanted nothing to do with it, much like what the marketplace is seeing around glyphosate and the response to the World Health Organization’s calling it a “probable carcinogen.”

Like it was able to do by selling its Posilac/rbGH division to Eli Lilly. Monsanto could raise the funds for an acquisition and corporate restructuring by selling off its Roundup division to a private equity group or other interested buyer. It could continue to capture the financial upside of its Roundup Ready product line with licensing agreements that relate to their genetically engineered, Roundup Ready products, without carrying the PR responsibility and liability on its balance sheet.

Monsanto isn’t in business to save the world. It’s an agrochemical company. If one division appears to be increasingly weak, the fiduciary duty of the company’s executives is to address it. And in many cases, that can look like a merger, acquisition or sale.

Let someone else turn it around.

Few investments firms are saying anything. Transactions of this size, either debt deals or M&A activity, can enrich financial analysts who back the company and the banks they work for, despite red flags.

It’s not the first time for something like this to happen. Analysts ignored the erosion of Enron’s core business, as the company made millions in transaction fees for the banks.

A merger between Monsanto and Syngenta would create a lucrative deal for the banks overseeing it. Banks benefiting from debt and equity deals less inclined to report negatively for fear of losing those deals.

The world feels fragile, particularly in a geopolitical and economic sense, says my friend Vikram Mansharamani over at Yale.

As global concern around Monsanto’s products grow, along with currency concerns, declining commodity prices, inventory issues, health concerns and more, it appears that Monsanto’s business model just might be increasingly fragile, too, and that an M&A activity is intended to shore it up.

Just as Enron’s tagline encouraged us to “Ask Why,” perhaps it’s time that we do the same with Monsanto.

Sources:

https://www.ire.org/resource-center/stories/18758/

http://fortune.com/2015/04/01/roundup-cancer-monsanto/

http://www.agriculture.com/news/business/with-oil-prices-falling-c-ethol-stay_5-ar46185

http://news.agropages.com/News/NewsDetail—13305.htm