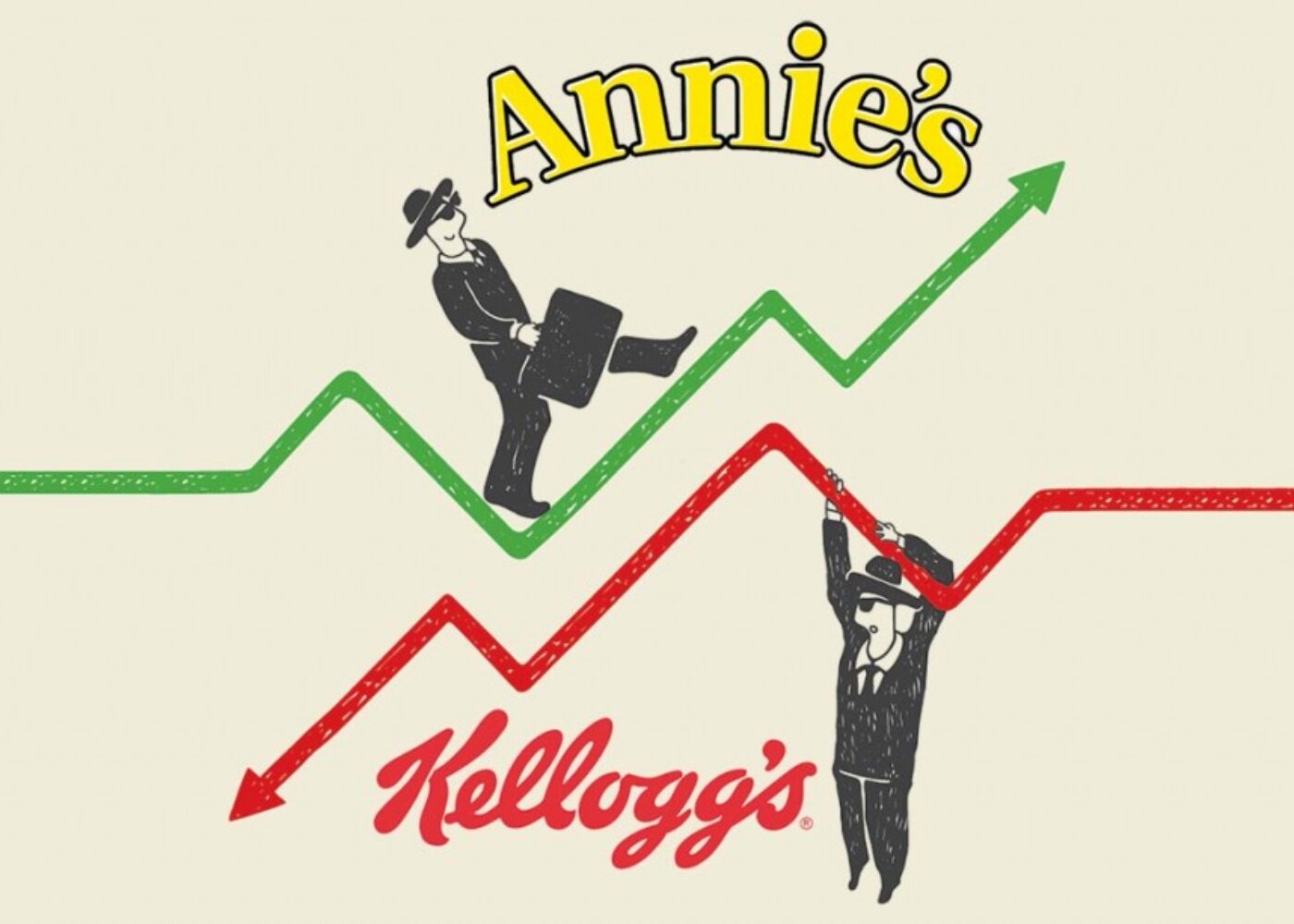

GMO vs Non-GMO: A Tale of Two Stocks

If the market is any indication, a look at the share price and escalating growth of Annie’s versus the collapsing growth of Kellogg’s tells a story about our food supply that no marketing campaign can.

In the last year, due to soaring consumer demand for products free from artificial ingredients, Annie’s growth has exploded. Annie’s most recent quarter saw $57.9 million in net sales, representing a year over year increase of 24%. Earnings per share were up 19.1% and consumption up 22%. Annie’s, which produces real food with real ingredients, also just made a $6 million plant acquisition to expand capacity.

Contrast that with Kellogg, which just announced “Project K”, an initiative in which they will be laying off 7% of their employee base, along with an announced plant consolidation. In the United States, sales have been down for the last two quarters. Kellogg said sales in its U.S. Morning Foods segment fell by 2.2%. And while they recently purchased Pringles, to expand into the snack food category, Kellogg said sales in the U.S. snacks segment also fell by 2.5%.

A food awakening is happening around the country, largely driven by the escalating rates of conditions like allergies, diabetes, obesity and cancer. Consumers can no longer afford to remain illiterate in what they are putting into their bodies. The companies that recognize this are seeing explosive growth and skyrocketing share prices.

Chipotle is another recent example. Wall Street fell in love with their non GMO burrito, and their shares soared on the announcement that they would remove genetically engineered ingredients (and the portfolio of chemicals required to grow them) from their product line.

Companies like Kraft would give their right arm for that kind of revenue growth and upward trajectory in share price. What they have yet to realize is that they don’t have to, they simply have to give up the junk—like artificial dyes, artificial growth hormones and genetically engineered ingredients and meet the consumer where she stands—in the aisles of the store, holding onto a kid with allergies, asthma, diabetes, ADHD or any number of the conditions impacting our children today.

This demand for clean food is no more of a fad than the rates of cancer, autism and other conditions impacting our families. Farmers, food companies and families are paying attention, and first-movers are securing the market advantage.

The food awakening is on. As companies, along with the consumers, wake up to this, it begs the question: Which stock will be the next one to soar?